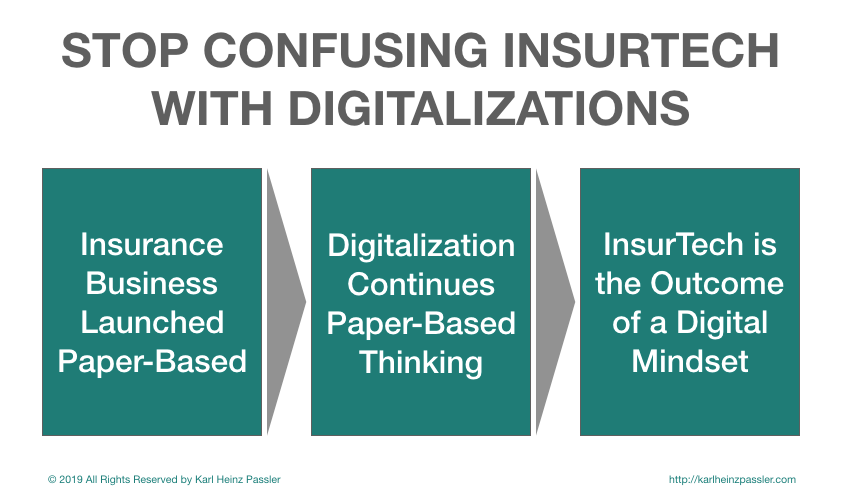

Stop Confusing InsurTech with Digitalization

The insurance business is under attack. Premiums, profits, and policyholders’ satisfaction are decreasing. Digitalization and InsurTech can fix this. But don’t muddle up the two concepts!

The Insurance Business Launched Paper-Based

For generations risk carriers recorded information, calculated tariffs, issued coverages, and managed claims. The best medium to process these business trades was paper. After decades of prosperous insurance operations, insurance products, and procedures are all predicated on tackling a paper. This belief is presently holding insurers back to adapt accordingly to the digitalization of our economy.

Insurance is a ‘simple’ financial cover in the event of a monetary loss. It’s an abstract promise, called into life by ‘issuing’ a policy. Simply take the paper away, and what remains is a digital product: a promise to pay and a monetary transaction. That’s all.

Insurance Digitalization Continues Paper-Based Thinking

Historically insurance was an exceptionally people-intensive business enterprise. Sales, servicing, and claims handling employed a lot of (paper-pushing) agents, clerks, specialists, and supervisors.

However, with the introduction of digital data processing in the 1980s, the back office of this industry was digitized. Insurance providers got faster, more economical, and more profitable. But on the other side, the business practices more in-depth paper-based thinking than ever.

Most insurance executives have not yet recognized how much policyholders’ digital expectations have passed what incumbent carriers can do. These executives contribute to confusion, uncertain responsibilities, and in persevering the wrong strategy.

InsurTech is the Outcome of a Digital Mindset

In this technologically savvy world “just” digitizing the paper-based company isn’t enough. There’s the brand new thinking of going about insurance. InsurTech startups, their leaders, and influencers esteem insurance as a strictly digital product.

InsurTech protagonists refuse the think paper-based and unite a promise to pay, and a financial transaction with:

Artificial Intelligence, offering a 24/7 service (e.g., chatbot service)

connected devices, providing on-demand protection (e.g., usage-based cover)

big data, protecting till recently uninsurable risks (e.g., crop cover)

Hey Insurers: InsurTech is thinking Digital-First!

InsurTech startups think digital-first. They subsequently leverage technology to generate innovative products, services, and business models. You can read about it in the insurance press daily.

Leading #insurance carriers think and act differently. They think digital first, partner with #InsurTech #startups, and follow-up digitizing the rest.

Insurance providers can’t last their paper-based services, procedures, and business models. Digitizing only leaves it faster, but will not resolve the underlying factors behind decreasing premiums, profits, and policy holder’s satisfaction.