Wie das Zurich Innovation Lab seinen Konzern beflügelt

Führende Versicherer nutzen Innovationslabore, um ihre digitale Transformation zu beschleunigen. Diese „Innovation Labs“ entwickeln digitale Produkte und Dienstleistungen – getrennt vom operativen Geschäft. Aber wie genau funktioniert das?

Die wachsende Bedeutung von Ökosystemen und Plattformen für Versicherer (Teil 4)

Digitale Ökosysteme im Versicherungsmarkt: Wachstumschance oder Transformationsdruck? Im vierten Teil des Insurance Strategy Talk 2020 entschlüsseln wir, wie Versicherer traditionelle Grenzen durchbrechen und die Chancen digitaler Plattformen strategisch nutzen können.

Das Erfolgsgeheimnis der Deutsche Familienversicherung (Teil 3)

Digitalisierung als Schlüssel zum Erfolg: Die Deutsche Familienversicherung zeigt, wie Innovation kleine Versicherer groß macht. Im dritten Teil des Insurance Strategy Talk sprechen wir mit dem Vorstandsvorsitzenden über Strategien, die Chancen digitaler Ökosysteme zu nutzen und die Versicherungsbranche neu zu denken.

Praxisbericht: Die Chancen und Hürden für Smart Home und Versicherungen – (Teil 2)

Smart Home in der Versicherung: Zwischen digitaler Revolution und unerschlossenen Potenzialen. Im zweiten Teil des Insurance Strategy Talk 2020 entschlüsseln wir, wie vernetzte Technologien die Versicherungswelt herausfordert. Werden Versicherer Vorreiter oder Getriebene der Smart Home-Transformation?

Grundlagen Plattformen, digitale Ökosysteme und Versicherungen (Teil 1)

Digitale Plattformen transformieren die Versicherungsbranche: Werden Sie Getriebene oder Gestalter der digitalen Zukunft? Im Insurance Strategy Talk 2020 entschlüsseln wir die Chancen und Risiken dieser globalen Entwicklung für neue Wertschöpfungsmodelle, Zusammenarbeit und Kundenbindung.

Next Steps for the Blockchain in Insurance

This panel discussion on the topic of Blockchain was performed at InsurTech Rising International 2019 at Station F in Paris. It was moderated by me (Karl Heinz Passler), and contributed by Oliver Volk (Allianz); Frank Desvignes (AXA Next Labs), and Philip Proost (B3i).

The ‘FinTech meets InsurTech’ Breakfast Club

Uli Kleber, The Digital Insurer’s news correspondent for Germany, met up with FinTech influencer Samarth Shekhar from SixThirty Ventures and InsurTech influencer Karl Heinz Passler (InsurTechTalk) to discuss what FinTech and InsurTech have in common.

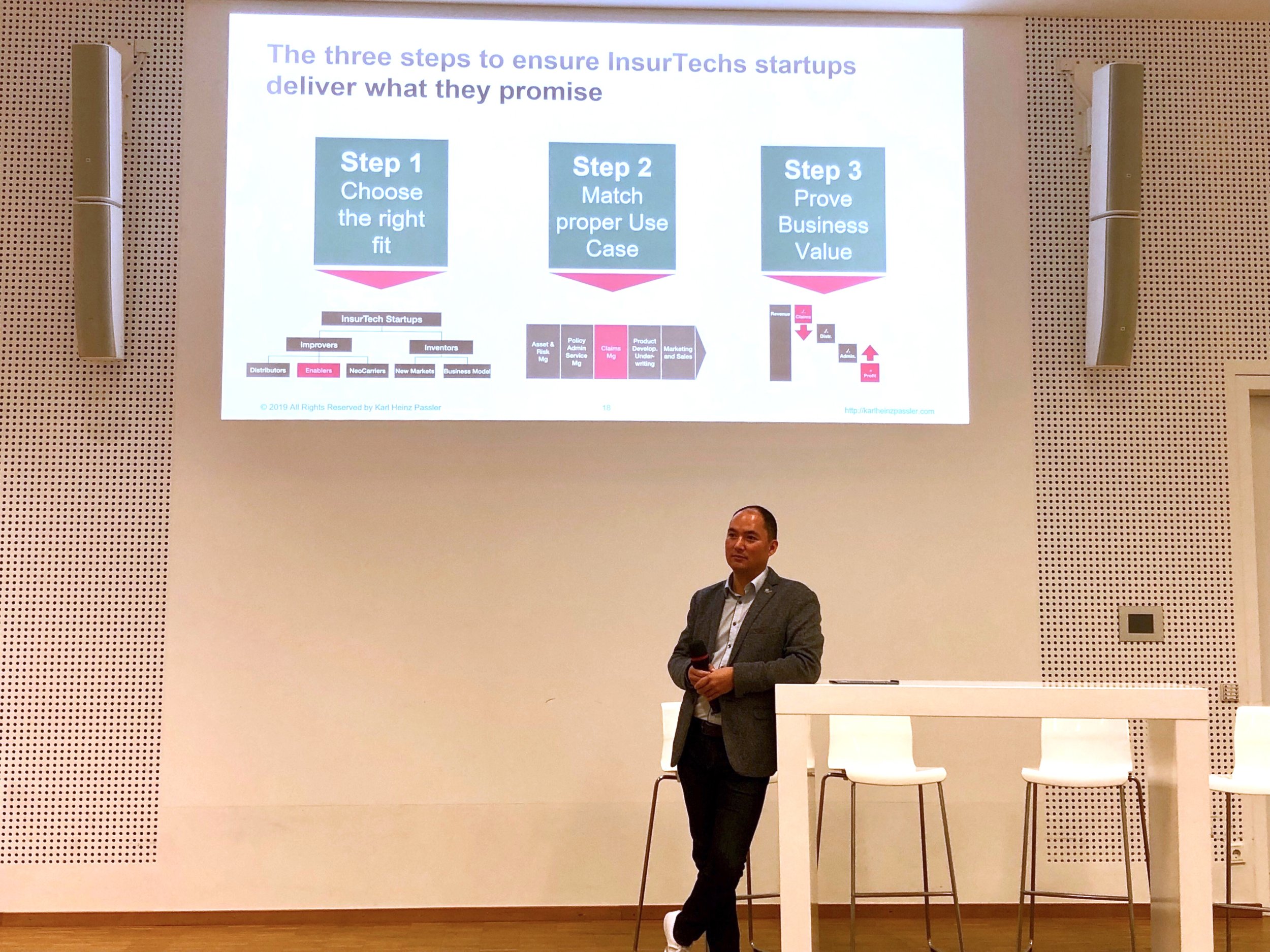

An Assessment Scheme to Ensure InsurTech Startups Deliver on Their Promises

InsurTech Value Decoded: Navigate the Startup Landscape with a Proven Three-Step Validation Framework. Discover how insurers can systematically assess, select, and leverage innovative InsurTech partnerships to drive transformative business outcomes.

A Step-by-Step Guide to Picking the Perfect Insurtech Startup

For those innovating within an incumbent insurance company, picking the right insurtech startups is crucial—but challenging. How do you separate real value from hype? Watch my lessons learned from the opening keynote at the Global InsurTech Summit in Istanbul, Türkiye.

Lessons from the InsurTech Frontier

The insurance industry is undergoing transformative change in the digital age. At the Digital Finance World 2019 in Frankfurt we discussed how InsurTech startups are revolutionizing the sector with innovative ideas and customer-focused solutions.

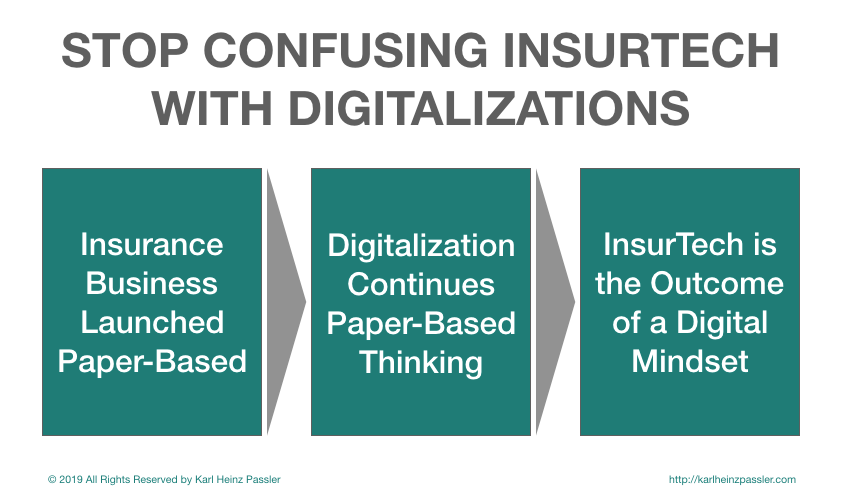

How to Recognize Valuable InsurTech Startups and Avoid Common Pitfalls

Most insurance companies have recognized the value of collaborating with InsurTech startups. However, from the perspective of incumbents, the sheer number of startups can be overwhelming—at first glance, they all seem alike. The real challenge lies in distinguishing genuine InsurTech innovators from those merely riding the digitalization wave. How can insurers identify true InsurTech pioneers and avoid wasting resources on pretenders?

Stop Confusing InsurTech with Digitalization: A Wake-Up Call for Insurance Leaders

The insurance industry is facing unprecedented challenges. Declining premiums, shrinking profits, and eroding policyholder satisfaction signal the urgent need for change. While digitalization offers incremental improvements, it is InsurTech that holds the key to true transformation. Understanding the difference is critical—don’t confuse the two.

The 3 Must-Have Types of Capital almost Every InsurTech Startup Needs

The insurance industry is home to over 1,000 startups seeking capital. Yet, many InsurTech startups aren’t aware of the different types of capital required to not just survive but thrive. So, what types of capital are essential for their success? Let’s break it down.

A Roadmap for Strategic Collaborations with InsurTech Startups

Discover how insurers can revolutionize their business through strategic partnerships with innovative InsurTech startups. This comprehensive guide provides three proven steps to unlock the full potential. Including insights from Baloise Group's successful innovation journey. Held at the Connected Insurance Europe 2019 in Amsterdam.

10 Ways to Make Motor Insurance Exciting and Engaging - for Policyholders

Let’s face it – motor insurance isn’t exactly the most thrilling topic. Moreover, the similarity of insurance products often sparks a price war among competitors, leading to diminishing customer loyalty and rising acquisition costs. But in today’s world, where consumers crave personalized and memorable experiences, even motor insurance can be transformed into something exciting.

Transforming Insurance Through InsurTech Startups - from The InsurTECH Book

New startups are reshaping the insurance industry. InsurTechs tackle pain points with tech-driven solutions, some incrementally, others with bold moves. Drawing on insights from my chapter in The InsurTechBook, I’ll examine what the key differences are, and wich ones have the potential to deeply change the industry.